Millwork News 2/1/21 -

Rest assured that Main Street is doing everything we can to make sure our customers are taken care of in this unprecedented time; however, product availability and

delays are still common throughout our industry. Here is the latest news from one of our leaders in worldwide moulding and millwork procurement. -

It seems 2021 is beginning much the same as 2020 ended – with millwork demand exceeding supply. While retail volume has tapered slightly, it remains in record territory. Housing

indicators also point to continued strength in demand for new construction.

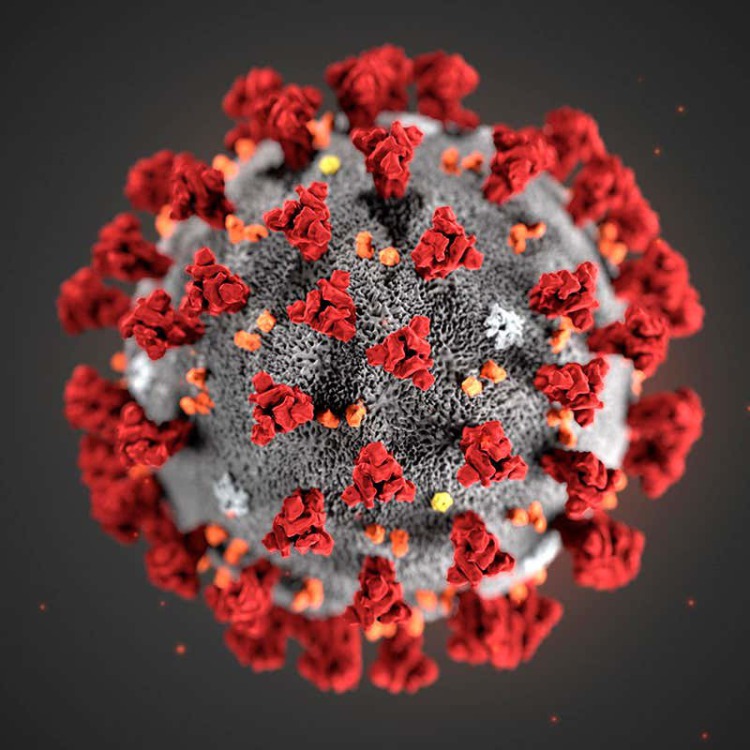

What we’re seeing is an unbelievable compounding of constraints on supply. Limited shipping containers worldwide, low log supply, fires in plants, and COVID outbreaks all add up

to a severely impaired supply chain.

It’s likely we’ll see prices continue to increase monthly for the next few months. Here’s a look at the RISI/Crow’s FJ moulding index in the context of the last 13 months – already up

34% year over year Here are some of the specific supply challenges that surfaced in the last 2 weeks:

Ocean Freight

Over the last several weeks we’ve seen a rapid increase in surcharges for Ocean Freight. Contracted carriers have greatly reduced

container capacity, and many loads are subject to spot rates ranging from $3,000-$7,000 in excess of contracted rates coming out of

Indonesia. Spot rates are even higher out of China. We expect to see the same challenge with spot rates surface out of South America as well. We’re also seeing Ocean Freight delays due to

limited container availability and congestion at ports worldwide due to COVID protocols.

Chile

At Promasa, longer-term plans are developing to increase the capacity of primed FJ mouldings, split jambs, and shaker doors.

However, historic production levels are a challenge currently due to the number of employees out with medical passes related to COVID. Last week the largest Chilean producer reported a

major COVID outbreak in their primary plant. They are reducing all of their customers’ allocations by 25%.

Brazil

Increased domestic demand and export demand into non-US markets is a constraint on supply out of Brazil. Additionally… One significant producer of FJ Mouldings and door stiles had

a major fire last week which will delay their production 4-5 weeks. Several Brazilian producers report excessive rains in south Brazil are prohibiting access to the forests. Limited

and delayed supply of logs is expected to delay moulding production 2-4 weeks. Another Brazilian moulding and split jamb supplier is completely off the market for at least January and

February – again due to limited log supply.

Domestic Production

Composite lumber price index started to turn down over the last week, but dimension is still trading near record levels. Sawmills

are focusing their production on the highest margin items. As a result, there is limited and very expensive industrial lumber

available for re-manufacturers of millwork products.